Chapter One

Photos

Photographs of people, places, and things mentioned in chapter one. The number on the left indicates the page on which the content of the photo is mentioned in the book. Many of the photos also link to additional material.

Page 4 -- "Man Controlling Trade" consists of two larger-than-life sculptures in front of the Federal Trade Commission (FTC), one of which is pictured here. If you are interested, the General Services Administration has produced a brief video about the history behind these two iconic statues. The statues are making a point. The horse is trade. It is powerful, useful, and impressive. But it is also potentially dangerous and destructive. It must be tamed, reined in. For that, we need someone or something that is also powerful and has some brains. To the rescue comes the FTC, the man controlling trade. The premise is that an unregulated market will do as much harm as good; a regulated market can be put to work for society's benefit without causing harm. This is an optimistic, even heroic, view of regulation and regulators. But it is not one that every observer accepts.

Page 4 -- Artist David Spear has produced a contemporary but intentionally anachronistic version of the same subject.

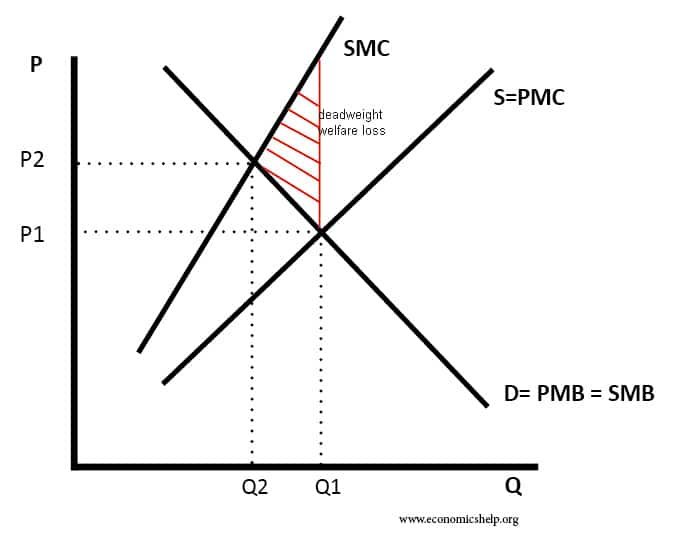

Page 5 -- Here is a standard graph – a version can be found in any economics textbook – illustrating negative externalities. The Y axis (“P”) shows the price of a good or activity; the X axis (“Q”) shows its quantity. SMC = Social Marginal Cost; SMB = Social Marginal Benefit; PMC = Private Marginal Cost; PMB = Private Marginal Benefit; S = Supply; D=Demand. The graph illustrates that in the presence of negative externalities, too much of a good is produced (Q1); were those costs not external, i.e. if social and private marginal benefit were identical, then the point at which costs exceeded benefits would be further to the left (at Q2).

Page 12 -- Two behavioral economists have been awarded the Nobel Prize: Daniel Kahneman (2002) and Richard Thaler (2017). Kahneman (who by training is a psychologist, not an economist) is pictured here.

Page 12 -- Richard Thaler

Page 16 -- Arthur Cecil Pigou (1877-1959) was educated at, and for many years taught at, Cambridge University. His best-known and most important work was The Economics of Welfare (1920), which developed the concept of externalities (first articulated by Pigou’s teacher, Alfred Marshall) and argued that negative externalities should be taxed and positive externalities subsidized.

Pages 31-32 -- An editorial cartoon from the Oct. 27, 1909 Wall Street Journal (though originally appearing in the Des Moines Register and Leader) depicting the judicial constraints on the ICC.

Page 33 -- James Landis, cited at the bottom of the page, was a member of the FTC, Chair of the SEC, dean of the Harvard Law School, chair of the CAB, and an advisor to President Kennedy (in which capacity he gets much of the credit for the creation of the Administrative Conference of the United States). His book, The Administrative Process, remains influential. His illustrious career ended in scandal and despair after a criminal conviction for failure to pay income taxes. The link will take you to his obit, which was front-page news in the NY Times.